How to Read the Us Census Data in Python

Python is often used for algorithmic trading, backtesting, and stock market place analysis. In fact, information technology seems virtually the canonical use-case for many tutorials I've seen over the years. Getting financial data in Python is the prerequisite skill for any such assay.

- 1 Highlights

- 2 Fiscal Data 101

- 3 Pandas

- 4 Required Libraries

- v Yahoo Finance

- 5.ane Using Pandas-Datareader

- 5.2 Using yfinance

- 6 Quandl

- half-dozen.1 Quandl Python Library

- six.2 pandas-datareader

- vii Alpha Vantage

- vii.ane Unofficial Python alpha_vantage API

- vii.2 pandas-datareader Alpha Vantage API

- 8 Google

- 9 Using the Data

- 10 Review

In this commodity, you'll learn how to easily get, read, and interpret fiscal data using Python. We'll exist using the Pandas library, the yfinance library, and a handful of useful helper methods. Readers should be familiar with basic Python syntax but needn't have obtained a level of skill mistakable every bitguru.

Highlights

- Understanding structured vs. unstructured financial data

- What is OHLC data

- Popular Python financial libraries

- Getting data from diverse sources via Python including Yahoo Finance, Quandl, and Blastoff Vantage

- Deprecated APIs such as Google Finance

Financial Information 101

Fiscal data comes in many forms. The canonical format is tabular information (thinkspreadsheets) which can be formatted as rows and columns. This type of information is available from many sources such as finance.yahoo.com, Quandl, Alpha Vantage, and many brokerages.

Fiscal information can be bought, manually scraped from the web, or obtained from public APIs. Generally, fiscal data comes in 1 of 2 principal types:

- Structured Data: Closing prices, financials, market place performance, etc.

- Unstructured Data: News articles, Social Media, Sentiment Analysis, etc.

Additionally, financial data tin can be further categorized as either Historical or Real-Time. In well-nigh cases, Real-Time data isn't bachelor from public APIs and must be purchased. Nosotros'll be using by and large structured historical information for our examples here. These fiscal data are generally provided in a format that includes the following information:

- Date

- Open Price

- High Price

- Low Price

- Closing Price

- Volume

These information—often referred to asOHLC Nautical chart Data—tin can be interpreted equally Time Series data and are perfect for performing technical analysis. We'll dive into this format in merely a moment but, for now, just realize this is a standard format for historical pricing data within financial markets.

Pandas

Pandas is a powerful data science library that stores tabular data into retentiveness in a very efficient manner. Information technology makes the opening, processing, and subsequent saving of information fast and effective. It comes with a range of helper methods, information classes, and in the case of financial data—web APIs!

This article will glaze over much of the intricacies of the Pandas library—just know that it is complex! We will be generally using the data_reader function, the DataFrame grade, and miscellaneous statistic-generating functions like caput(), info(), summary() and etc.

Required Libraries

At present that we know what to expect from our information, let's consider how to get some financial data using Python! Before we go started, make certain the following packages are installed as they will be relevant for each data source. We'll cover specific packages every bit we move forth.

# Install the pandas library pip install pandas # Install the pandas-datareader library # Note: Will too install pandas if not already installed. pip install pandas-datareader

Yahoo Finance

Pros:

- Costless

- Huge corporeality of data

- Well-supported Python libraries

- Integrated with many backtesting libraries

Cons:

- No official API is available

- Basic data only

- Tin get IP rate-express or banned

Yahoo Finance provides historical data for a massive number of securities. You'll find data for securities, currencies, and fifty-fifty cryptocurrencies like Bitcoin ($BTC-USD). We can use the pandas-datareader library as well every bit the yfinance library to get fiscal information from Yahoo Finance. Permit's consider both approaches:

Note: I would suggest using a proxy when accessing yahoo fiscal data. Both the yfinance library and pandas-datareader libraries accommodate this.

Using Pandas-Datareader

import pandas_datareader as pdr # Request data via Yahoo public API data = pdr.get_data_yahoo('NVDA') # Display Info print(data.info()) <class 'pandas.core.frame.DataFrame'> DatetimeIndex: 1258 entries, 2016-08-08 to 2021-08-05 Data columns (total 6 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 Loftier 1258 non-null float64 one Low 1258 non-nada float64 two Open 1258 not-nothing float64 3 Close 1258 not-zero float64 four Volume 1258 not-null float64 5 Adj Close 1258 non-null float64 dtypes: float64(6) retentiveness usage: 68.8 KB Here we see a 5-year historical menses of OHLC information for $NVDA (NVidia Corporation) provided equally a pandas' DataFrame object with 1258 rows of data. Excluding imports and summaries—that took asingle line of lawmaking.

Using yfinance

For this approach, we need to install the yfinance library as pip install yfinance. This library provides ample tools for working with financial data requests to the Yahoo Finance website. Keep in listen, yet, this is not an official API and is bailiwick to rate limiting, periodic breakage, and general quirkiness. Nonetheless, its the defacto Python library for OHLC data and can exist used equally follows:

import yfinance as yf # Request historical data for past v years data = yf.Ticker("NVDA").history(period='5y') # Show info impress(data.info()) <class 'pandas.core.frame.DataFrame'> DatetimeIndex: 1258 entries, 2016-08-08 to 2021-08-05 Data columns (total 7 columns): # Cavalcade Non-Null Count Dtype --- ------ -------------- ----- 0 Open up 1258 non-aught float64 1 Loftier 1258 non-nil float64 ii Low 1258 non-goose egg float64 three Close 1258 non-zero float64 iv Volume 1258 non-null int64 5 Dividends 1258 not-null float64 6 Stock Splits 1258 non-null float64 dtypes: float64(6), int64(i) retentivity usage: 78.6 KB Here nosotros come across the same 5-year historical data for $NVDA returned equally the familiar pandas' DataFrame object. We've used a little more than circuitous syntax but achieved the same basic result. The yfinance library'southward Ticker form doesn't actually retrieve information. The history method helps usa with that and takes a number of optional parameters.

By default, yfinance returns a previous months' data as a daily time series. Note this method adds ii additional columns: Dividends and Stock Splits; and also omits the adapted close column. The Adjusted Close information takes into account such actions a dividends payouts and stock splits. The inclusion here assumes we're comfortable calculating our ain adjusted close.

Quandl

Pros:

- Gratuitous to use (charge per unit limited)

- Datasets tin can be downloaded

- Official Python Library

- Good API documentation

Cons:

- Limited OHLC data

- No real-time or delayed data for stocks

- A express number of gratis datasets

- Free API access for non-rate limited utilize (or freer access at least)

Quandl is one of the largest information providers in the world. Their self-confessed mission is the "inspire customers to make new discoveries and incorporate them into trading strategies." They've been effectually since 2013 and offer millions of free datasets. Yes, millions.

In 2018 they were acquired by NASDAQ and take connected to remain an authority on financial data ranging from equities and futures to options, currencies, and other non-financial market information such as housing, free energy, and agriculture.

Quandl offers official APIs to access any public dataset for free. Here we'll see how to get OHLC information via the official Quandl python library and also via the pandas-datareader. 1 important note is that the free Quandl OHLC information just goes up to 2018 at the time of this article's writing. If y'all need more recent data and don't want to pay this source isn't for you.

Quandl Python Library

To get started with Quadl's official API nosotros need to install the python library equally such: pip install quandl. This will install the official quandl python library and let usa make up to 50 daily API requests without registering an business relationship. Let's go our financial data:

import quandl # Become data via Quandl API data = quandl.get('WIKI/NVDA') # Summarize print(data.info()) <class 'pandas.core.frame.DataFrame'> DatetimeIndex: 4825 entries, 1999-01-22 to 2018-03-27 Data columns (total 12 columns): # Column Not-Zero Count Dtype --- ------ -------------- ----- 0 Open 4825 non-nada float64 1 High 4825 non-null float64 two Low 4825 non-cipher float64 3 Close 4825 non-null float64 4 Volume 4825 non-zero float64 v Ex-Dividend 4825 non-null float64 half dozen Dissever Ratio 4825 non-null float64 7 Adj. Open 4825 not-null float64 8 Adj. Loftier 4825 non-nil float64 9 Adj. Depression 4825 non-zero float64 10 Adj. Close 4825 not-null float64 eleven Adj. Volume 4825 not-nada float64 dtypes: float64(12) memory usage: 490.0 KB Our information is similar to earlier; it's all the same a pandas' DataFrame object, it still contains rows and columns, simply we've got alot more of it. By default, the quandl API returns all available data for the requested asset. Engagement ranges can be specified using a start_date="YYYY-MM-DD" and end_date="YYYY-MM-DD" pair of keyword arguments to the get method.

Note that our ticker syntax has inverse a bit from the yfinance case. Instead of requesting "NVDA" we're now requesting "WIKI/NVDA." This syntax instructs the Quandl API to query the WIKI dataset for an entry labeled NVDA. Read the documentation for more than on that.

pandas-datareader

Every bit with the Yahoo Finance information, the pandas-datareader library also accommodates requests to the Quandl API. However, this arroyo requires that one have an API cardinal to provide as an statement. API keys are free, don't require any payment methods to be stored, and tin be obtained via the Quandl signup page.

Notation: you will have to confirm your email address before the key becomes active. With our API key in hand, nosotros can become data via the pandas-datareader library as such:

# Necessary imports import pandas_datareader as pdr # Request Data data = pdr.get_data_quandl("NVDA", api_key="YoUrApIkEyGoEsHeRe") # Summarize impress(data.info()) <class 'pandas.core.frame.DataFrame'> DatetimeIndex: 411 entries, 2018-03-27 to 2016-08-08 Data columns (total 12 columns): # Column Not-Null Count Dtype --- ------ -------------- ----- 0 Open up 411 non-null float64 1 High 411 non-null float64 ii Depression 411 non-null float64 3 Close 411 non-null float64 4 Book 411 non-nil float64 v ExDividend 411 non-null float64 6 SplitRatio 411 not-aught float64 7 AdjOpen 411 not-null float64 8 AdjHigh 411 non-goose egg float64 ix AdjLow 411 non-null float64 10 AdjClose 411 non-zero float64 11 AdjVolume 411 non-null float64 dtypes: float64(12) memory usage: 41.vii KB Hither we see another familiar image: historic OHLC data provided every bit a pandas' DataFrame class object. The QuandlReader course in pandas-datareader will default to the WIKI dataset if only a ticker is provided. This makes for convenient OHLV requests but may cause some confusion when trying to retrieve data from other datasets. Merely stick to the Quandl-recommended syntax of DATASET/QUERY for those.

Alpha Vantage

Pros:

- Free to use

- Big Amounts of Datasets

- Offers Technical Indicators

- Good API documentation

- Intraday Data

Cons:

- Rate limiting of API access

- Real-Time Data is delayed

Blastoff Vantage supplies a myriad of complimentary data via API access. These data are free simply not public meaning you need an API key. Such keys tin be obtained by registering an account with Alpha Vantage. Inbound your name, email, and status (educator, student, investor, etc.) will earn you an API primal in a matter of seconds—you don't even have to confirm your email! Let'due south take a look at getting data from this API.

Unofficial Python alpha_vantage API

At that place is not official Python library for the Alpha Vantage API and their official documentation only details common HTTP requests via the requests module. This approach is 100% valid and volition provide the OHLC data without event. Syntactically, it'southward a bit more than cumbersome.

In pursuit of some sugar for our syntactic sugariness tooth, we'll use the well-developed alpha_vantage library. This is an unofficial API merely, at least in my experience, the defacto Python Alpha Vantage API library. Permit'south see how this library can retrieve our OHLC data:

from alpha_vantage.timeseries import TimeSeries # Create an API object ts = TimeSeries(cardinal='UNO4CZQHSBZSN71N') print(type(ts)) # Go daily OHLC data for NVDA information, meta_data = ts.get_daily(symbol="NVDA") print(data) { '2021-08-05': { 'one. open': '205.0000', '2. high': '207.3300', 'iii. depression': '203.4200', '4. close': '206.3700', '5. volume': '21143537' }, '2021-08-04': { '1. open': '199.9000', '2. high': '203.1800', '3. depression': '198.2800', '4. shut': '202.7400', '5. book': '23130940' }, ... '2021-03-xvi': { '1. open': '534.2600', '2. high': '540.5000', '3. low': '524.6700', 'iv. close': '531.6500', '5. volume': '6803240' } } We tin see here the concluding several month's worths of OHLC data from the Alpha Vantage database. However, we've got our showtime curveball: our information is returned as a dictionary object rather than the pandas DataFrame class object we've come to know and love. To get back to the nuts, we demand just supply the following argument to the TimeSeries object instantiation: output_format='pandas'. With that, our data looks like this:

one. open 2. high 3. low 4. close five. volume engagement 2021-08-05 205.00 207.33 203.4200 206.37 21143537.0 2021-08-04 199.ninety 203.18 198.2800 202.74 23130940.0 2021-08-03 197.40 202.22 192.2000 198.15 30181074.0 2021-08-02 197.00 199.61 193.6100 197.50 21744397.0 2021-07-xxx 194.xviii 196.30 192.6300 194.99 18349746.0 ... ... ... ... ... ... 2021-03-22 516.51 535.78 516.2700 527.45 7445077.0 2021-03-nineteen 510.00 516.86 504.5000 513.83 7480174.0 2021-03-18 525.46 527.36 508.6817 508.90 7354702.0 2021-03-17 521.59 538.xiii 519.5800 533.65 6096605.0 2021-03-16 534.26 540.fifty 524.6700 531.65 6803240.0 [100 rows x 5 columns]

Ahh, that's much amend. Now nosotros can see that we accept a 5-column DataFrame with 100 rows. To get more than the previous 100 periods' worth of data, y'all can utilise the outputsize='full' argument in the ts.get_daily() method. This will return all available data.

pandas-datareader Alpha Vantage API

Once more, the pandas-datareader library offers like shooting fish in a barrel access to OHLC data via Alpha Vantage integration. The post-obit code volition call back historical data for $NVDA once again:

import pandas_datareader as pdr # Get Alpha Vantage Data data = pdr.get_data_alphavantage("NVDA", api_key='EnTeRYoUrApIKeYhErE') # Summarize print(data.info()) Alphabetize: 5027 entries, 2001-08-13 to 2021-08-05 Information columns (total 5 columns): # Column Non-Nix Count Dtype --- ------ -------------- ----- 0 open 5027 non-goose egg float64 1 high 5027 non-null float64 2 low 5027 not-nix float64 3 close 5027 not-null float64 4 volume 5027 non-zippo int64 dtypes: float64(4), int64(one) retentiveness usage: 235.half dozen+ KB Here we see historic OHLC data for $NVDA all the way back to 2001. This is much more data than the default method of other approaches so exist prepared to filter as necessary via the showtime or end functions. Note: the pandas-datareader get_alphavantage method uses the TIME_SERIES_DAILY argument by default. Consult the Blastoff Vantage API documentation for more information on alternatives.

Pros:

- Integrates with Google Sheets

Cons:

- Not available via API

- No Python library

- Officially close down in 2012

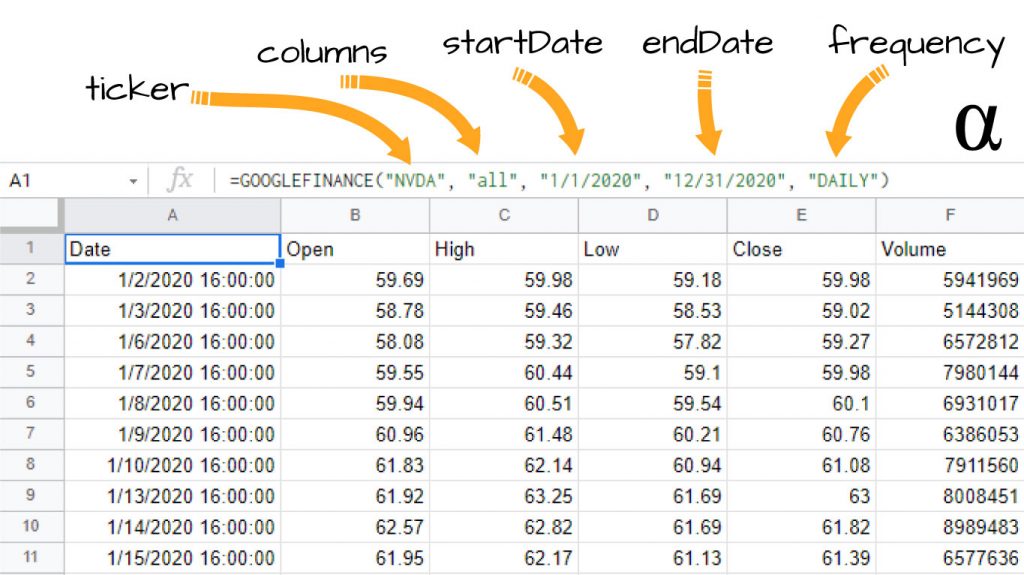

Equally of Oct 2012 Google no longer offers a financial API service. This news came as a daze to many but was ultimately reflective of many policy changes to public APIs. Google likewise does not provide financial data via metered APIs, as evidenced by a search on their APIs explorer. The Google Finance APIis however available nonetheless only simply equally an Excel-style formula in Google Sheets:

This isn't a Python-centric way of getting financial information and is included hither only because of historical relevancy. I suppose one could hack together an HTTP asking method in Python for this—merely that's beyond the scope of this article. Bank check out the official Google Documentation for more information and syntax related to the GOOGLEFINANCE part in sheets.

Using the Data

Getting historical stock prices in Python is all well and expert merely what is ane to exercise with such information? There are tones of approaches for analyzing OHLC data—allowing one to dribble many numbers of useful insights based on expected outcomes and use-case. Beneath are some projects that can go you started:

- Predicting Stock Prices in Python with Linear Regression

- Calculating the Moving Boilerplate Convergence Divergence (MACD) in Python

- Using the Stochastic Oscillator for Algorithmic Trading in Python

- Visualizing Autocorrelation in Fourth dimension Series Data with Python

- Correlation Assay with Heatmaps & Matrices in Python

These are merely a few common applications of OHLC fiscal data in Python. These tutorials details how stock data tin be used to place patterns, correlations, and fifty-fifty predict hereafter prices—all in the comfort of Python! Ultimately the only limitation to use of these data is the analyst's imagination!

Review

We've seen here that getting financial information in Python tin be approached in many ways. Whether via official APIs, well-supported third-party libraries, or even hacked-together approaches there seems no shortage of OHLC data to be had. These examples showcase why Python has emerged equally the defacto programming language for data science—financial data included.

The yahoo finance API, particularly via the yfinance library, is deeply integrated within many backtesting frameworks. Every bit such, information technology's been my feel that this library is the defacto source for daily OHLC celebrated information. It'due south not suited for intraday analysis or real-fourth dimension just proves invaluable for basic analysis.

The information sources here are not meant to be an exhaustive listing and are only cogitating of mutual sources available with easy access (minus Google of class.) Some sources provide downloads such that local information can be retained for more than efficient loading when entire universes of Stocks are being analyzed. The spider web-based admission APIs discussed hither are great for casual testing and on-the-go development.

koppplarriving1998.blogspot.com

Source: https://www.alpharithms.com/python-financial-data-491110/

0 Response to "How to Read the Us Census Data in Python"

Post a Comment